What is a Spot Bitcoin/Ether ETF?

A spot Bitcoin or Ether ETF (Exchange-Traded Fund) is a type of investment fund that tracks the price of Bitcoin or Ether directly. The term "spot" in this context refers to the physical or actual ownership of the underlying assets, as opposed to futures contracts. The price of the ETF is directly linked to the price of Bitcoin/Ether.

What is the Management Expense Ratio (MER)?

The MER is a measure of the total costs associated with managing and operating an investment fund. It is the total of the management fee, operating expenses, and other costs incurred by the fund. Investors often look at the MER as an important factor when evaluating the overall cost of investing in a particular fund. The lower the MER, the more cost-effective the fund is for investors.

Why should you care about the MER?

Great question! The MER is crucial for investors to consider because it directly impacts your overall returns. Over time, even seemingly small differences in MER can accumulate into significant amounts.

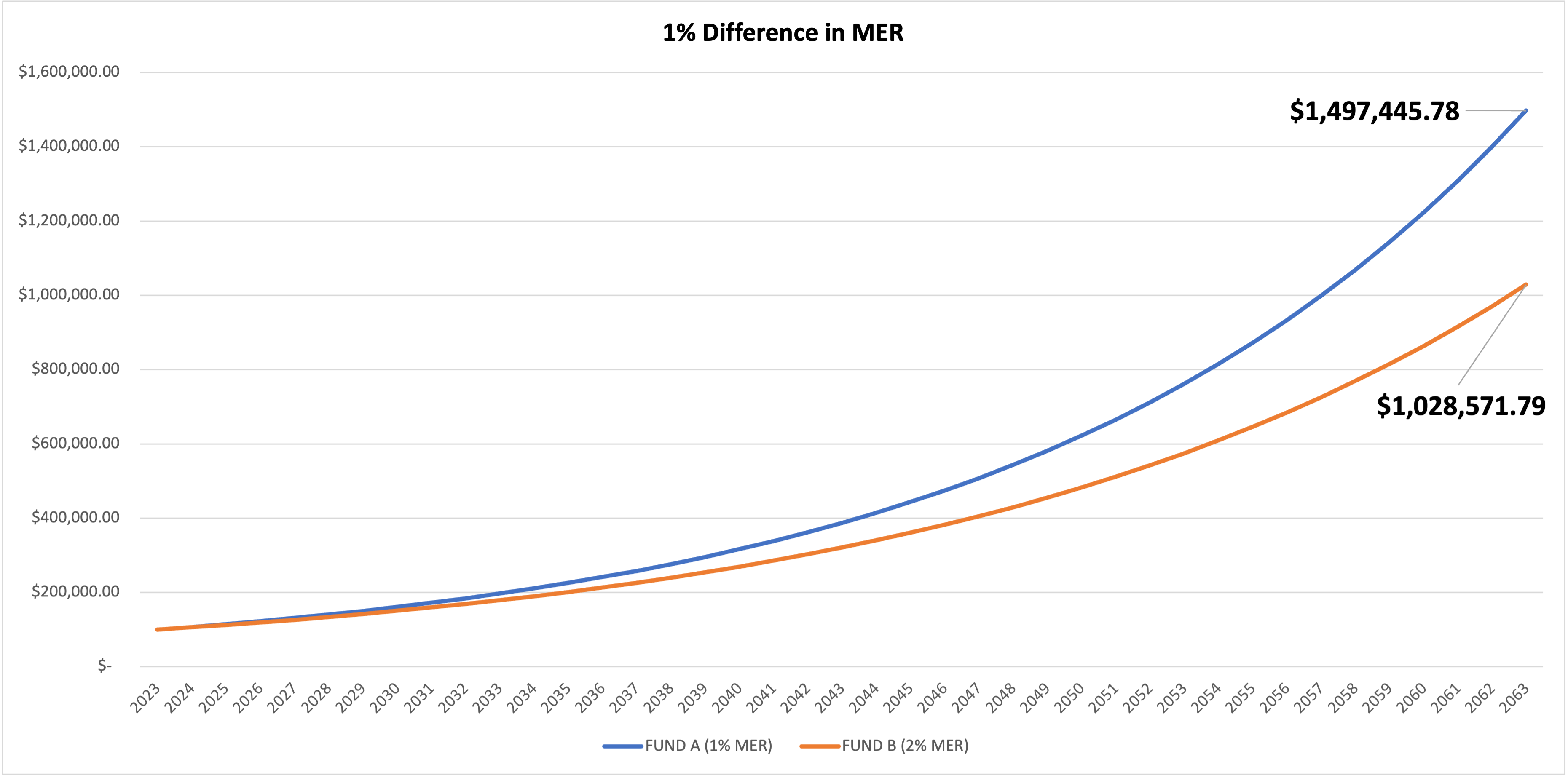

The impact of a 1% difference in the Management Expense Ratio (MER) becomes particularly significant over the long term due to the nature of compound interest.

Let's say you invest $100,000 and we have two funds:

Fund A with a 1% MER

Fund B with a 2% MER

Assuming both funds generate an average annual return of 8% before fees (which is a common assumption).

After one year, Fund A would have a return of $7,000, and Fund B would have a return of $6,000.

After 40 years, Fund A would have grown to $1,497,445.78, while Fund B would be at $1,028,571.79.

That 1% difference in MER over the course of several decades has resulted in a difference of $468,873.99 or 45.58%! This illustrates the power of compounding returns, and how reducing fees can significantly impact the growth of your investment over time. It's not just about the fees you pay today, but the compounding effect of those fees over the years.

Caring about the MER is a smart move for any investor looking to maximize returns and make informed decisions about their portfolio. It's all about keeping more of what you earn!

2022.01.01 - 2023.09.22 Canadian BTC ETF Performance Comparison

The two funds with the lowest MER's (Fidelity's FBTC and CI Galaxy's BTCX.B) have performed the best since 2022.

2023.01.01 - 2023.10.06 ETH ETF Performance Comparison

The fund with the lowest MER (CI Galaxy's ETHX.B) has performed the best over 2023 year to date.

What are the advantages of buying a Bitcoin/Ether ETF?

Ease of Access: Buying a Bitcoin ETF is similar to buying stocks on a traditional exchange. This makes it easier for investors who are already familiar with brokerage accounts and traditional investment platforms.

Regulatory Oversight: Bitcoin ETFs are subject to regulatory oversight, which can provide a level of investor protection. Regulatory approval implies that the ETF meets certain standards and complies with regulations set by financial authorities.

Security and Custody: The ETF provider is responsible for securely storing and managing the Bitcoin or Ether holdings. Investors do not have to worry about the technical complexities and potential security risks associated with storing and self-custodying their assets.

Tax Efficiency: Buying and selling shares of a Bitcoin or Ether ETF may have potential tax advantages compared to direct ownership. ETF shares can be held in tax-advantaged savings accounts like a TFSA or RRSP. In a TFSA, buying and selling activities (trades) are not subject to capital gains taxes. Investors could potentially avoid capital gains taxes by holding Bitcoin or Ether ETF shares in their TFSA instead of owning Bitcoin and Ether directly.

Interested in buying and selling thousands of stocks and ETFs, commission-free? Join Wealthsimple and get up to $3,000 when you sign up with my referral code: MNC4WW or go to https://app.wealthsimple.com/74rd/3i2t30pp